Which Intangible Assets Are Amortized Over Their Useful Life

The Amortization of Intangible Assets is the process in which purchases of non-physical intangibles are incrementally expensed across their appropriate useful life assumptions. Depreciation Expense 100 Accumulated Depreciation 100.

Ch12 Accounting Intermediate Ind

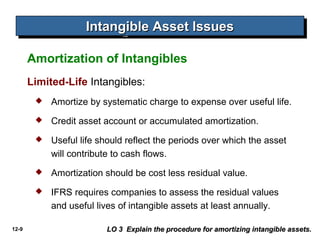

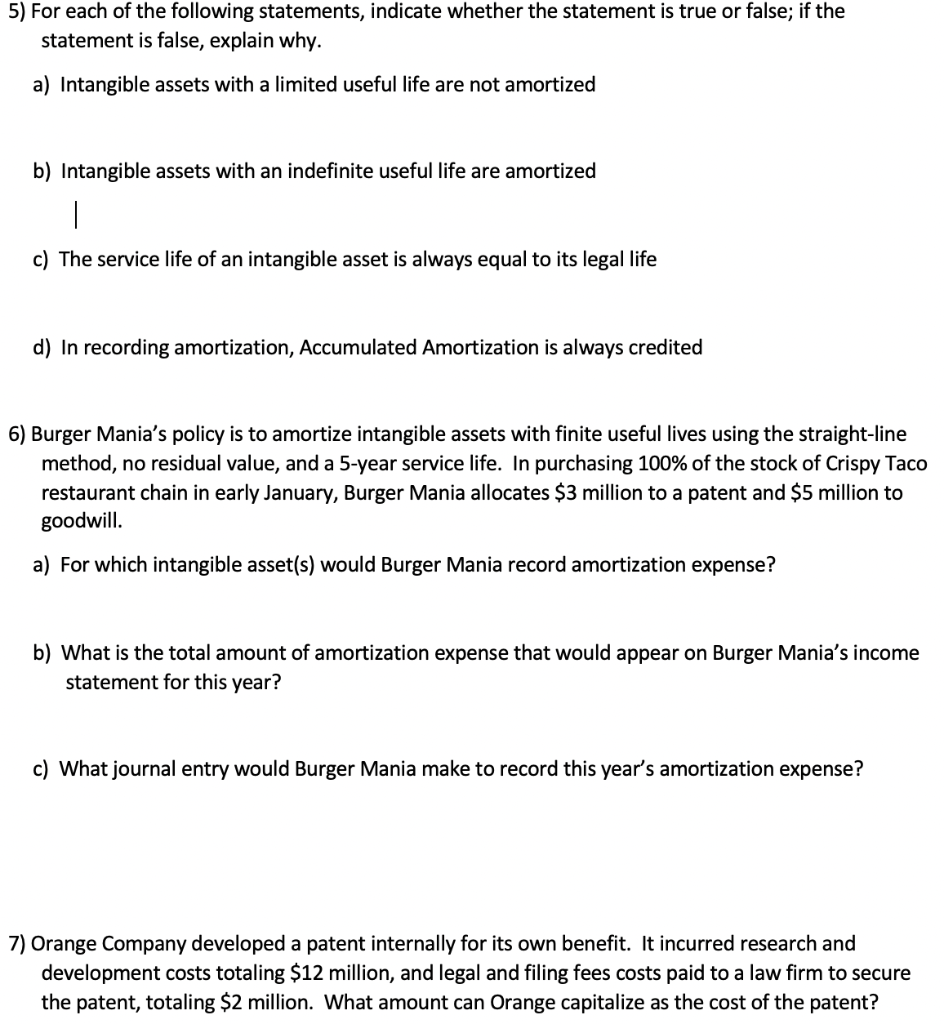

If an intangible asset has a finite useful life then amortize it over that useful life.

. The IRS requires you to amortize intangible assets over 15 years or 180 months. The amount to be amortized is its recorded cost less any residual value. Thus you need to amortize only assets with a finite life over their useful life on a systematic basis.

What is the relationship between the term of a loan and the monthly payment if all else remains constant. Straight-line depreciation is the usual method used to calculate amortization. Jeff Corporation purchased a limited-life intangible asset for 120000 on May 1 2006.

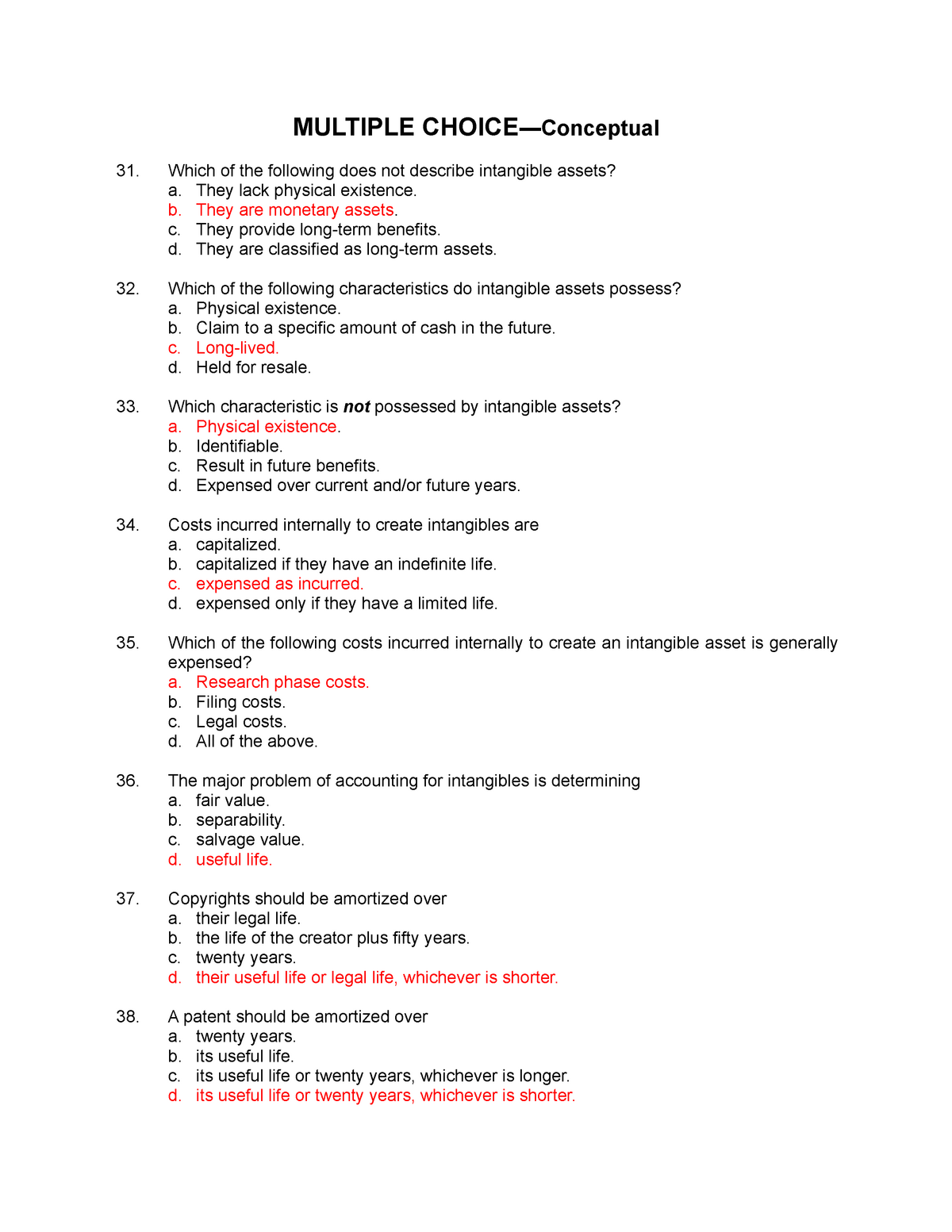

Amortization is the written off the intangible asset for its useful life. Intangible assets with _____ lives have their cost allocated over their useful lives while intangible assets with _____ lives should not be amortized. As discussed above intangible assets are classified on the basis of their useful life.

Which intangible assets are amortized over their useful life. Assets which have definite life are amortized only. If a fixed asset such as a computer were purchased on January 1 for 3750 with an estimated life of 3 years and a salvage or residual value of 150 the journal entry for monthly expense under straight-line depreciation is a.

However the assets with an indefinite useful life are not amortized. For example goodwill is not amortized because its usage can be more than the life of the business. Companies use the useful life of assets to guide their decisions on whether or not to amortize them on their financial statements.

Intangible assets are amortized over their remaining useful life or their statutory life whichever is shorter. Amortization of Intangible Assets. Which intangible assets are amortized over their useful life.

While depreciation is the expensing of a fixed asset over its useful life amortization is the practice of reducing the value of an intangible asset over a. In an effort to avoid recession the government implements a tax rebate. It has a useful life of 10 years.

One of the effects of periodic amortization of an intangible asset on the financial statements is that. However intangible assets are usually not considered to have any residual value so the full amount of the asset is typically amortized. These intangibles can only be amortized under Section 197 if you created them as a substantial part of buying the assets of a business.

Intangible Assets Attribution Most intangible assets like goodwill or patents are amortized over their estimated useful lives. Amortization is a cost allocation process to systematically allocate the cost of long-term intangible assets over their useful life. All of these choices are correct.

EVEN WITH THE GUIDANCE IN FASB STATEMENT NO. For tax purposes the cost basis of an intangible asset is amortized over a specific number of years regardless of the actual useful life of the asset as most intangibles dont have a. The amortization should reflect the pattern of benefits expected from the asset.

What total amount of amortization expense should have been recorded on the intangible asset by December 31 2008. Intangible assets include proprietary software contracts and franchise agreements. Which intangible assets are amortized over their useful life.

If the company is unable to determine the pattern then the straight-line method is used. Conceptually the amortization of intangible assets is identical to the depreciation of fixed assets like PPE with the non-physical nature of intangible assets being the main distinction. Goodwill the difference between the purchase price of a business and the business total asset value 4.

An intangible asset with a finite useful life is amortized on a systematic basis over its useful life. Intangible assets such as patents trademarks copyrights are amortized because they have limited useful life. What happens to the principal portion and interest portion of the monthly payment on a loan over time.

142 th e useful life of certain intangible assets is difficult to judge particularly assets that involve contracted or other legally set terms. These include intangible assets with a finite life and ones with an indefinite life. A franchise trademark or trade name.

Franchise Individuals often obtain what type of intangible asset in order to be granted the right to use a certain trademark or trade name. Depreciation Expense 1200 Accumulated Depreciation 1200 b.

Amortization Of Intangible Assets Definition Examples

Multiple Choice Multiple Choice Conceptual Which Of The Following Does Not Describe Intangible Studocu

Solved 5 For Each Of The Following Statements Indicate Chegg Com

Intangible Asset Impairment Boundless Accounting

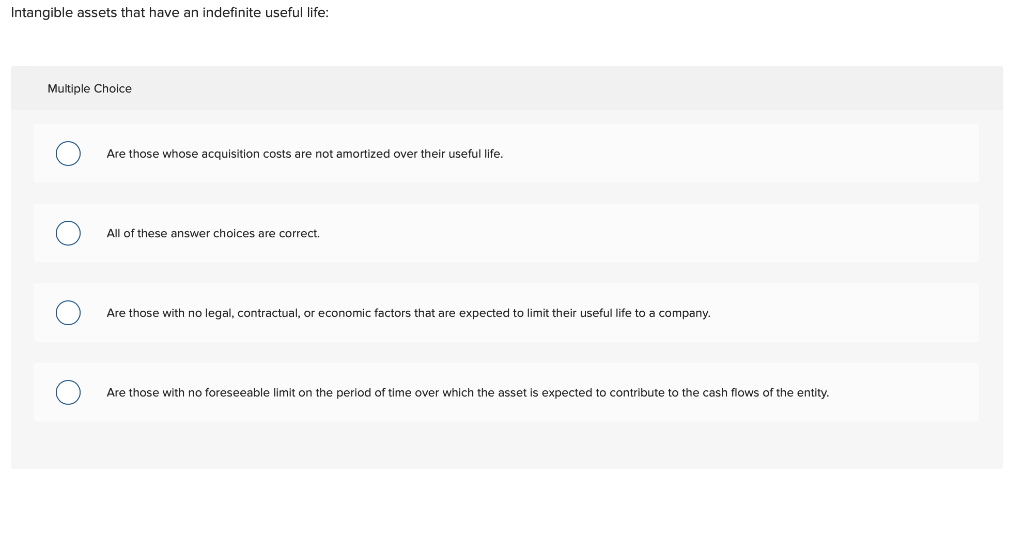

Solved Intangible Assets That Have An Indefinite Useful Chegg Com

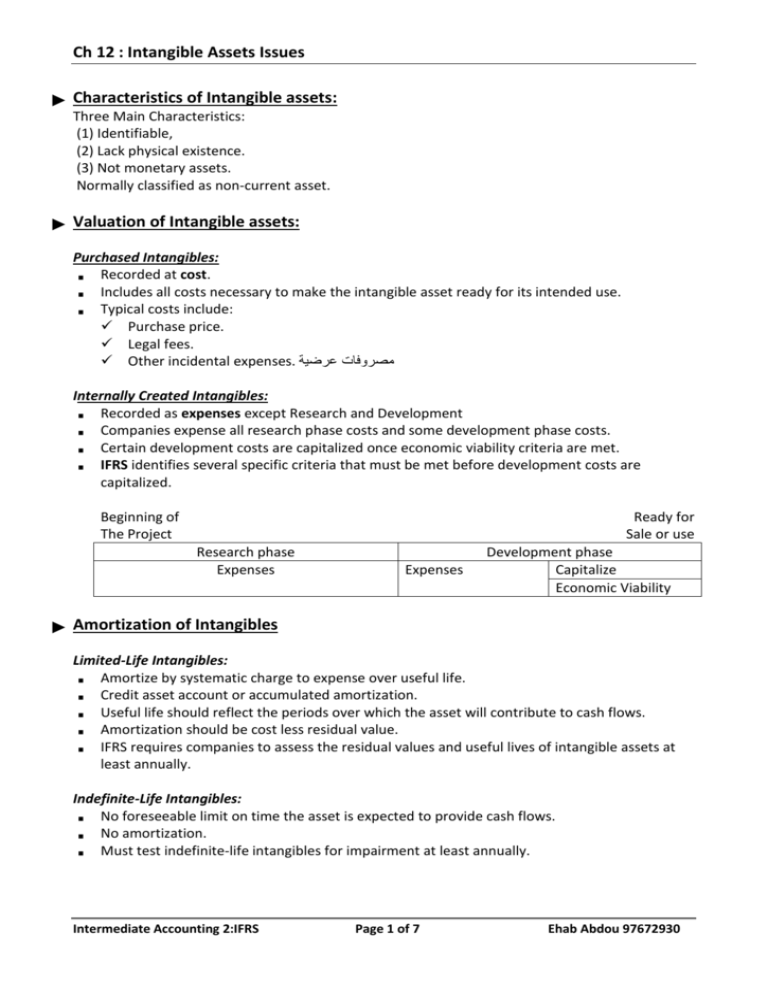

Ch 12 Intangible Assets Issues Characteristics Of Intangible Assets

Chapter 12 Intermediate 15th Ed

Plant And Intangible Assets Chapter 9 Prezentaciya Onlajn

Chapter 9 Long Term Assets Ppt Download

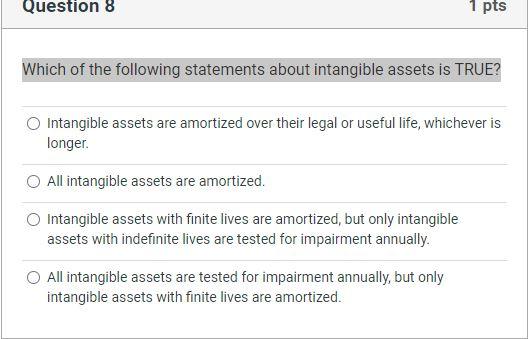

Solved Question 8 1 Pts Which Of The Following Statements Chegg Com

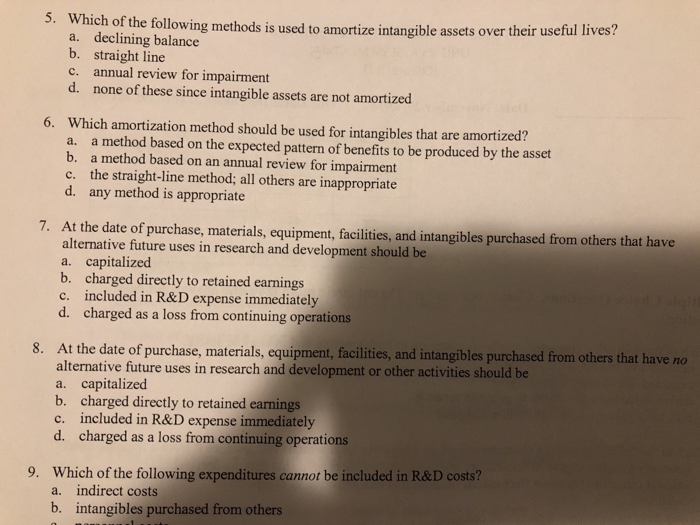

Solved 5 Which Of The Following Methods Is Used To Amortize Chegg Com

Acc 304 Week 11 Final Exam Strayer New

12 1 Actg 6580 Chapter 12 Intangible Assets Lo 1 Characteristics 1 Identifiable 2 Lack Physical Existence 3 Not Monetary Assets Normally Classified Ppt Download

Ch10 Plant Assets Natural Resources And Intangible Assets

Ch12 Pdf Pdf Goodwill Accounting Intangible Asset

Chapter 12 Intermediate 15th Ed

Amortization Of Intangible Assets Financiopedia

Administrative Quiz 4 Due Today Project 3 Due Monday 3 2 Final Exam Section 1 10 15 12 05 Wednesday 3 18 At 10 15 Section 2 5 30 Monday 3 16 At Ppt Download

Comments

Post a Comment