In a Limited Partnership the Limited Partners Quizlet

Partner contributions to a limited partnership do not automatically result in a limited partnerships liability but the partners are only liable for that liability up to capital contributions. A Limited Partner is typically an investor who has provided capital in exchange for a shared interest in the business.

2each limited partners liability is limited to the amount he put into the partnership.

. This company has not listed any contacts yet. A limited partnership LP exists when two or more partners go into business together but the limited partners are only liable up to the amount of their investment. It must provide that all partnership transactions be approved by all partners.

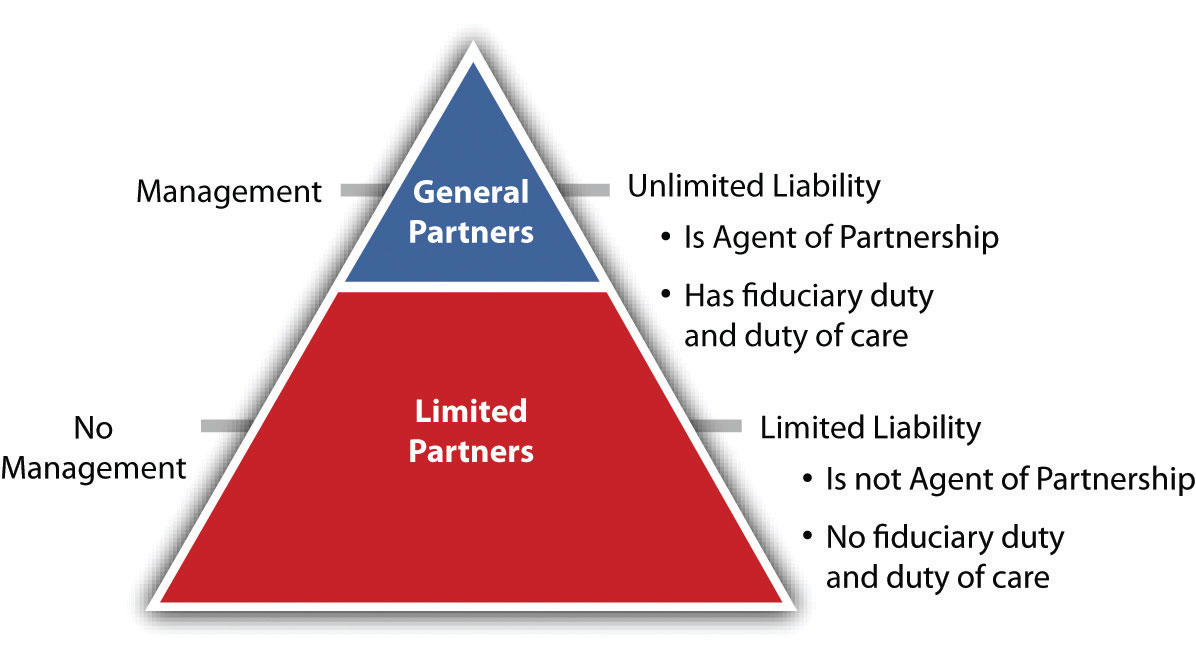

A limited partnership is a type of business partnership that involves a general partner responsible for the everyday operations and limited partners who invest in the business. All limited partners sometimes known as silent partners will serve solely as an investor in the business with the funds that they contribute being the extent of their liability. Multiple Choice 1each limited partners liability is limited to his net worth.

Managing owners with more than one share of ownership. D Limited partners may sell their interest in the company A Limited partners can only manage the business. What Is The Advantage Of A Limited Partnership Quizlet.

What Is The Role Of Limited Partners In A General Partnership Quizlet. Partnership can be started with any name of choice Conversely the limited liability partnership must use the word LLP by the end of its name. General partners have complete control over the management of the partnership although limited partners have a vote.

B One general partner must exist who has unlimited liability. In limited partnerships LPs at least. Accounting questions and answers.

FLPs have two types of partners general and limited. The companys File Number is listed as 0600013652. In contrast there is no limit of maximum partners in LLP.

1-limited to his or her personal net worth. Upon written consent of all general partners and of limited partners holding a majority interest. 4 The true owners of the corporation are the.

In a limited partnership each limited partners liability for the partnerships debts is. An LP is defined as having. Any two persons can start a partnership or LLP but the maximum number of partners in a partnership firm are limited to 100 partners.

4there is no limitation on liability. A Partnership Agreement Quizlet also provides that partnerships could be of various types. Due to limited partnerships liability over business debts it is easier to attract investors.

A family limited partnership is a business structure families can use to pool resources. However all of them can participate in the management of the business. Hence they are personally responsible for the debts incurred by the partnership.

A holders of debt issues of the firm. 5-limited to the total amount invested by all partners. 3-limited to his or her total earnings received from the partnership.

At the time specified in the limited partnership certificate. A limited partnership will dissolve. Only general partners will have unlimited liability.

Since Limited Partners are prevented from participating in business-related decisions they are provided a certain amount of protection from the financial andor legal obligations of the company. Security National Partners Limited Partnership is a New Jersey Limited Partnership filed On February 1 1994. Be mindful that limited partnerships will have at least one general partner who controls the.

While the limited partnership is different than a general partnership the limited partners can enjoy general partner-like qualities including the ability to manage the business like a general partner would as long as a formal contract is in place. Finance questions and answers. It does not contain information about dissolution of the partnership since it is an agreement of formation.

Limited partnerships LPs and limited liability partnerships LLPs are both businesses with more than one owner but unlike general partnerships limited partnerships and limited liability partnerships offer some of their owners limited personal liability for business debts. How will their liability be affected by this. C Only the name of general partners can appear in the name of the firm.

A business can form a limited liability company LLC that serves as the general partner and takes on all liability instead of having individuals take personal responsibility. 3each limited partners liability is limited to his annual salary. Upon dissociation of a general partner unless the agreement provides otherwise or the partners appoint a new general partner within.

It must provide that general and limited partners have equal voting rights. FLPs can be used to pass on significant assets without triggering taxes or probate. In this type of partnership all partners are considered to be limited partners with limited liability.

In a limited partnership. The first type is general partnership where the partners have no limited liability. What is a Limited Partnership.

A Limited partners can only manage the business. On the other hand there is the limited partner who only participates in the limited partnership with a capital contribution and therefore contributes to the limited partnerships equity. Only general partners will have limited liability.

7031 Koll Center Pkwy Pleasanton CA 94566. Businesses are taxed on their profits and losses on their own individual tax returns. Alaska Seaboard Partners Limited Partnership is a New Jersey Limited Partnership filed On May 1 1995.

The partnership failed and after disposing all its assets to pay partnership debts there. Terrance and Barbara created a limited partnership but inadvertently misstated its name in the certificate of limited partnership. Partners in a general partnership are personally liable for the debts and obligations incurred by the limited partnership.

Unlike a general partner a limited partner only has limited liability regardless of. A limited partnership has A as general partner B as limited partner and C as industrial partner contributing P100000 P50000 and services respectively. Is there any advantage to being a.

Search anybody by name e-mail address phone number online username or even friends in your address book and instantly return lots of info. The limited partner is only liable for the sum of their capital contribution also called a liability sum. The companys File Number is listed as 0600020071.

2-limited to the amount he or she invested into the partnership. The partners will have unlimited liability. A limited partnership is a relationship where one or more partners are not involved in the day-to-day management of the business.

Only a limitation on what the partner can earn.

Accounting 211 Test Prep Part 1 Chapter 12 Flashcards Quizlet

Igcse Economics Unit 4 Flashcards Quizlet

Chapter 20 Summary Flashcards Quizlet

What Is The Advantage Of A Limited Partnership Quizlet Ictsd Org

A Limited Partnership Must Have At Least Ictsd Org

Which Is An Advantage Of A Limited Partnership Quizlet Ictsd Org

Limited Partnerships Flashcards Quizlet

Chapter 8 Types Of Business Organizations New Combo Flashcards Quizlet

A Limited Partner S Capital Contribution To The Limited Partnership Quizlet Ictsd Org

A Form Of The Partnerships Business Entity Is Llp Quizlet Ictsd Org

A Limited Partnership Quizlet Includes A General Partner Ictsd Org

A Disadvantage Of A Partnership Is Quizlet Ictsd Org

R8 M5 Structures Part 1 Flashcards Quizlet

A Limited Partnership Provides Limited Liability To Quizlet Ictsd Org

Why Limited Partnership Ictsd Org

Comments

Post a Comment